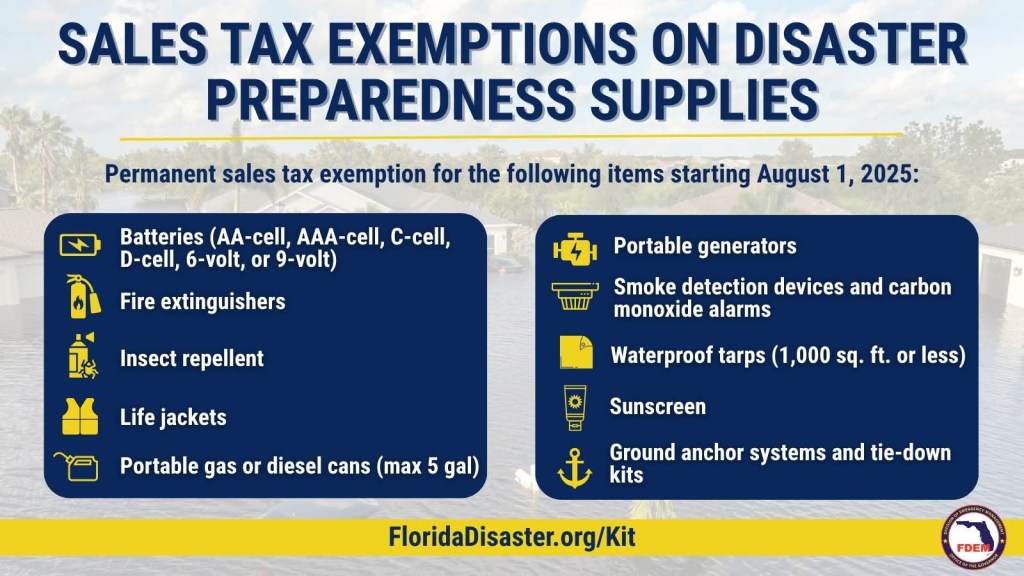

HOLT, Fla., Aug. 3, 2025—There is now no sales tax on specific hurricane supplies purchased in Florida.

Under the new budget signed by the governor, as of Aug. 1, some specific items are now permanently exempt from sales taxes.

Those include:

- AA-, AAA-, C-, D-cell batteries, and 6- and 9-volt batteries

- Bicycle helmets

- Carbon monoxide alarms and smoke detection devices

- Fire extinguishers

- Ground anchor systems and tie-down kits

- Insect repellent

- Life jackets

- Portable gas cans with a capacity of 5 gallons or less

- Portable engine-driven generators capable of producing 10,000 running watts or less

- Sunscreen

- Tarps 1,000 square feet or less

For a full list of disaster preparedness items, find a list here: https://floridarevenue.com/taxes/tips/Documents/TIP_25A01-05.pdf.

In addition to the permanent exemptions taking place Aug. 1, the back-to-school sales tax holiday runs through the end of the month.

This includes:

- School supplies up to $50 such as binders, notebooks, paper, pens, pencils and lunch boxes

- Clothing up to $100 such as pants, shoes, shirts, sweaters

- Wallets and bags such as backpacks, handbags, diaper bags up to $100

- Learning aids up to $30 includes interactive books, puzzles and flashcards

- Personal computers and accessories up to $1,500 includes laptops and desktop computers, tablets, printers, electronic book readers, flash drives, routers, headphones and calculators

For a full list of exempt school items, find a list here: https://floridarevenue.com/backtoschool/Pages/default.aspx.